As a nonprofit fundraising professional, you know how important it is to solicit financial gifts so your organization can purchase all of the goods and services you need to further your mission. But what if you could bypass the purchasing step and request donations of goods and services directly?

Good news: you can, by soliciting in-kind donations in addition to monetary ones! In-kind donations provide a new opportunity for your community to support your mission and take some of the stress of procurement off your nonprofit. In this guide, you’ll learn all you need to know about these types of gifts, including:

- What is an in-kind donation?

- Benefits and Challenges of In-Kind Donations

- In-Kind Donation FAQ

- How to Solicit In-Kind Donations

In some situations, in-kind donations can be even more useful for your nonprofit than financial gifts. However, you still need to ask for them strategically and handle them with care to make the most of them. Let’s dive in with an overview of exactly what in-kind donations are.

What is an in-kind donation?

The term “in-kind donation” refers to any non-monetary gift made to a nonprofit or to benefit a charitable cause. In-kind donations most often come in the form of physical goods or no-cost services. However, if another organization provides you with free use of an event space or a donor contributes an immaterial asset to your nonprofit like stocks or cryptocurrency, that is also considered an in-kind gift.

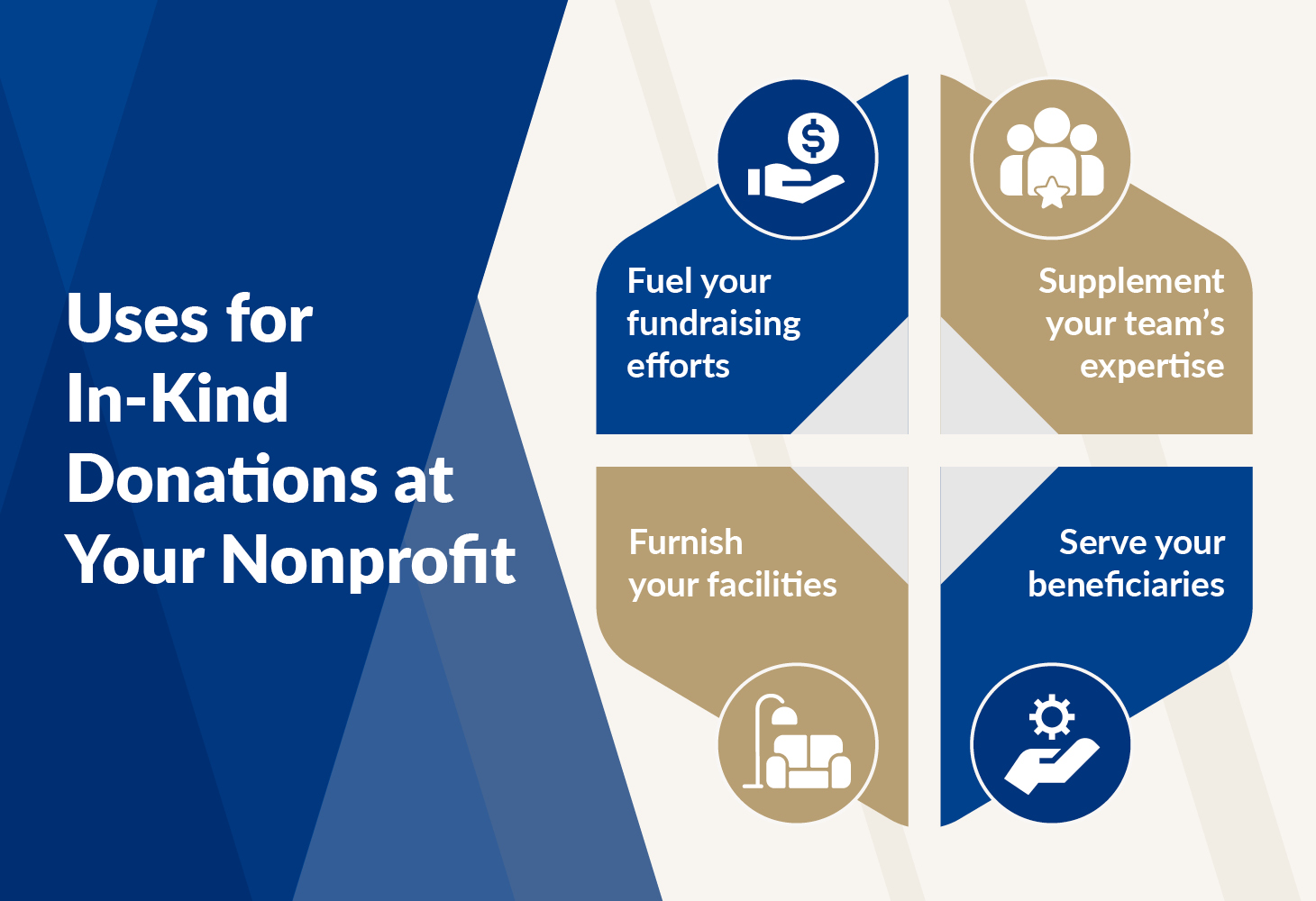

In-kind donations have several different use cases in a nonprofit context, including:

- Supplementing your team’s expertise. If you need help completing a specific project but don’t have enough work to warrant hiring another staff member, an in-kind donation of services from an external professional can allow you to meet your goal while saving money. For instance, a web developer might donate their time and expertise to design your nonprofit’s new website, or a lawyer could offer their services pro bono to negotiate a contract on your behalf.

- Serving your beneficiaries. Many nonprofits need specific items on a recurring basis to deliver services in their communities, which they can solicit directly from their supporters. For example, an animal shelter might host a monthly drop-off for pet food, dog beds, kitty litter, and other supplies they need to care for rescued animals. Or, a relief organization could ask for donations of canned goods, bottled water, and personal care items to deliver to individuals affected by natural disasters.

- Furnishing your facilities. If your organization is just getting off the ground or preparing to expand, you could benefit from in-kind contributions of office equipment or materials for new programs you’re launching. Plus, if your expansion involves construction, renovation, or decorating work, you might also be able to get some of those services donated.

- Fueling your fundraising efforts. Many of the fundraisers your organization runs involve upfront costs associated with specialized software, promotions, event space, and various other supplies. Your sponsors may donate various goods and services to help offset those costs, from designing marketing materials to providing food and beverages for event participants.

Auctions are one of the most important fundraisers to solicit in-kind donations for since you’ll need to procure a wide variety of items and keep event costs as low as possible to maximize your fundraising revenue. When you start planning an auction, get your team together to brainstorm a wish list of auction items. Then, identify which items would be easiest to secure as in-kind donations and divide up the responsibilities for soliciting them.

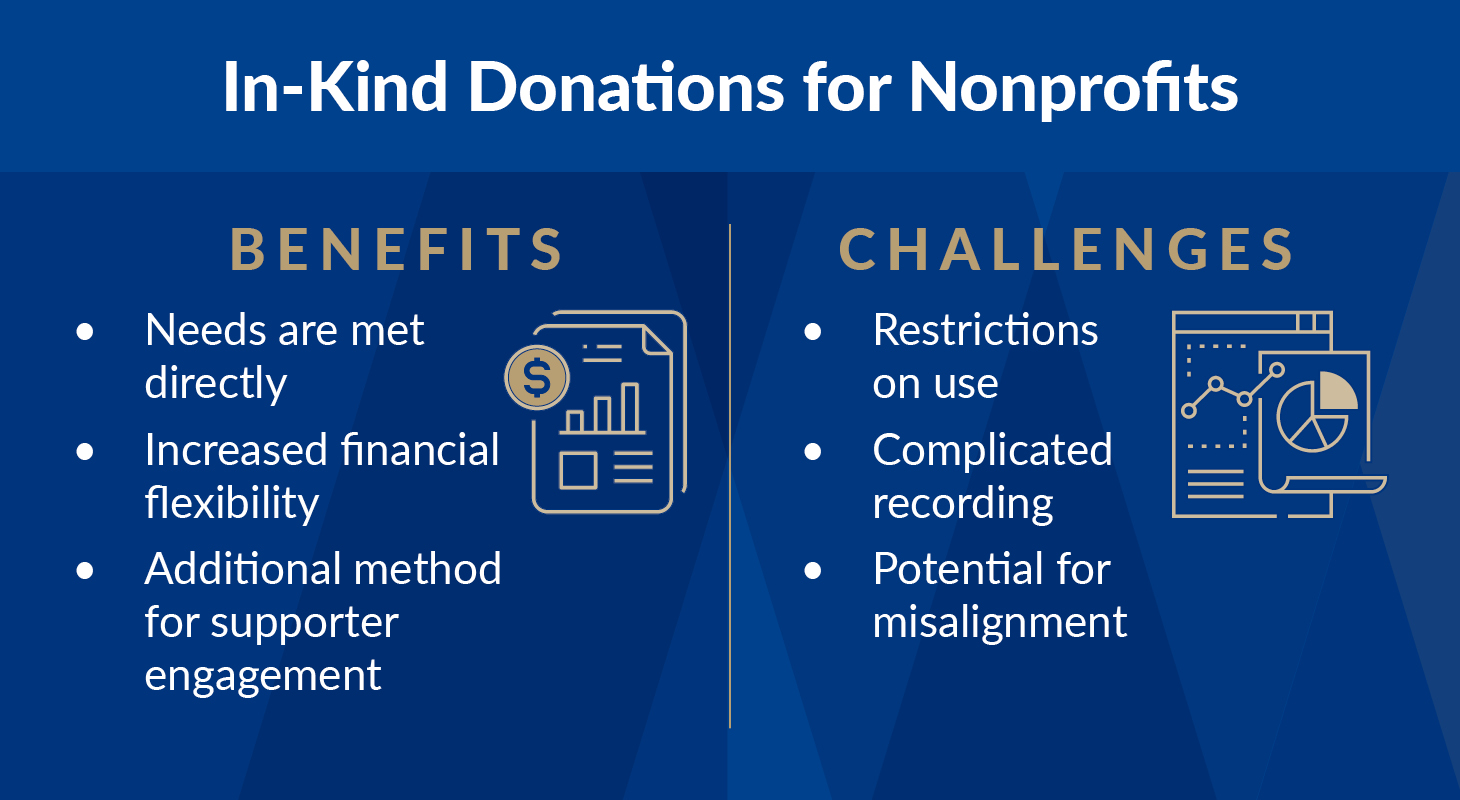

Benefits and Challenges of In-Kind Donations

Although in-kind donations can be useful for nonprofits in a variety of ways, they can be complicated to manage. Let’s look at some of the benefits and challenges of these gifts in more detail.

Benefits of In-Kind Donations

If your nonprofit solicits and handles in-kind donations effectively, you can experience advantages such as:

- Having your needs met directly. Instead of taking the time to purchase items and waiting for them to be delivered, you get exactly what you need from your supporters more quickly.

- Increasing your organization’s financial flexibility. If you receive some goods and services as donations, you’re free to put the money you would have spent on them toward other expenses at your nonprofit or save it for the future.

- Giving your supporters another way to engage with you. Some donors and sponsors might prefer to make in-kind donations because the gifts’ impact is more tangible. While other supporters may not have the financial means to make monetary donations, they can still contribute to your mission through in-kind gifts of expertise or items that they already have.

Challenges of In-Kind Donations

When accepting in-kind donations, be aware that you may encounter these difficulties:

- Restrictions on their use. In-kind donations generally have to be used for a specific purpose because goods and services are less flexible than cash by nature. Donors might add extra restrictions to their contributions as well. For example, a free event venue may only be available for certain dates, or a service provider might limit the scope of their pro bono work and charge you if you need additional help.

- Complicated recording. It’s much easier to understand and track the value of a monetary donation than an in-kind gift where you have to figure out its worth (more on this later). Plus, if many donors drop off items during a big in-kind donation drive, you need to keep careful tabs on who gave what in order to properly acknowledge those gifts (more on this later, too!).

- Potential for misalignment. No matter how much you communicate with donors about the in-kind donations they should and shouldn’t contribute, there is always the possibility that you’ll receive something you have no use for. You might even get some items that would be dangerous to give to your beneficiaries, such as expired food or broken toys.

Although these challenges are common, many nonprofits find that the benefits of accepting in-kind gifts far outweigh them. You just need to be careful about how you go about this process.

In-Kind Donation FAQ

To help you accept in-kind contributions more easily and safely, we’ll answer five of the most common questions that both you and your supporters may be wondering about. Of course, you may have additional concerns based on your nonprofit’s unique situation, which external fundraising specialists (like the team at Winspire!) can help you navigate.

Where do in-kind donations come from?

In-kind donations can come from any of your organization’s supporters, including:

- Individual donors. While individual gifts are vital for supply drives to succeed, donors may also be able to contribute in-kind services. If you’re planning a project that could benefit from outside expertise, check your supporter database to see if any existing donors or volunteers work in those fields and could help you out.

- Corporate partners. If your supporters can’t provide services for your nonprofit, consider contacting the companies in your community who specialize in those areas directly, especially if you have existing relationships with them. Businesses also tend to be the best sources for in-kind event sponsorships, whether you contact a performing arts center to donate musical tickets as a silent auction item or a restaurant to cater your gala.

- Other nonprofits. Nonprofits often help each other out in various ways, including through in-kind donations. For example, if your organization doesn’t have access to a good event space, another nonprofit like a museum or a park volunteer group might let you use theirs for free. Or, if another organization doesn’t sell one of their auction items and thinks it might appeal more to your nonprofit’s audience, they could give it to you for your next auction instead.

Building strong relationships in your community is critical to securing in-kind donations for your nonprofit. When you form a new connection with an individual or organization, follow up with them regularly and ensure your relationship is mutually beneficial so they’ll be more willing to contribute if you ask them for an in-kind gift later on.

What should my nonprofit do if we receive an in-kind gift we can’t accept?

The best way to solve this problem is to be proactive, since you’ll end up in a sticky situation if it happens.

Let’s say your nonprofit is collecting in-kind donations for your upcoming auction, and a supporter contributes a set of at-home spa items like facial masks, bath bombs, and scented lotion. You think these will make a great gift basket—until you realize that several products are missing their safety seals, meaning they would be dangerous to sell. How can you turn this gift down without coming off as ungrateful to this well-meaning donor?

The answer is to implement a gift acceptance policy at your organization. This preventative measure outlines the types of gifts—both financial and in-kind—that your nonprofit can and can’t accept, as well as the conditions under which you can receive each donation. You can (and should!) include clauses in the policy stating that you won’t take open or damaged consumable products and defining the concept of “gently used” for reusable goods.

With the backing of an official policy, you can work around your dilemma and more effectively tell a misguided donor, “Thanks, but no thanks.” Additionally, if you communicate your gift acceptance policy to your supporters, you’ll likely increase the percentage of in-kind donations to your organization that you can use.

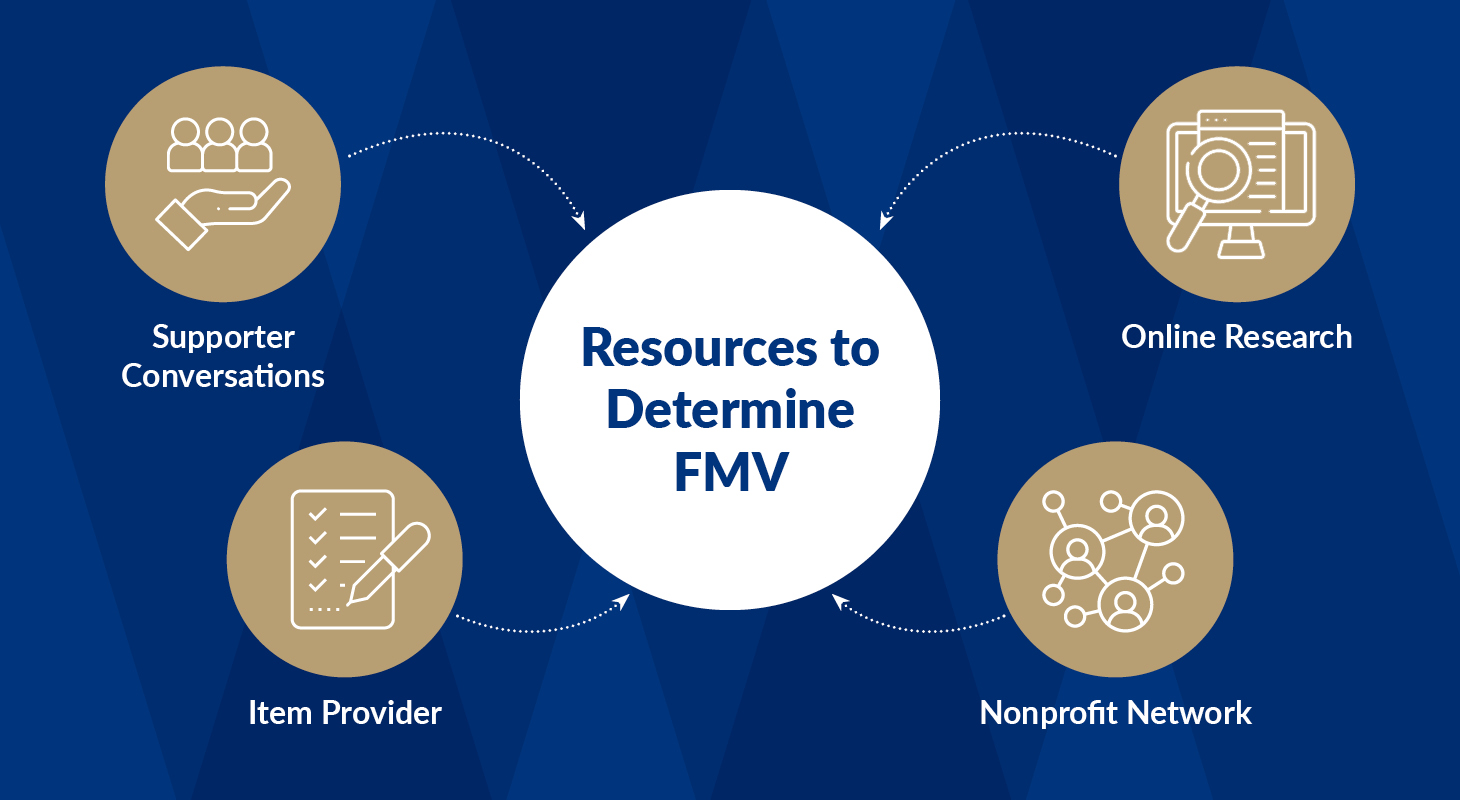

How is the value of in-kind donations determined?

An in-kind donation is worth its fair market value (FMV), which is the price you would pay for it if you purchased it on the open market. However, figuring out some gifts’ FMV can be more challenging than others.

Fortunately, there are a number of resources you can use to determine a good’s or service’s FMV, including:

- Online research. In many cases, you can look up the price of your gift or a comparable item online. For example, if someone donated a desk for your organization’s office, you could probably find the price of that desk or a similar model by checking the websites of a few furniture stores. If the item is unique, like a custom art piece, auction sites like eBay or online craft marketplaces like Etsy can be helpful in valuing it.

- Your nonprofit’s network. Contact other nonprofits in your community to see if they’ve received or bought something similar to your in-kind donation and what they recorded its value as. This method can be especially useful for valuing donated services. If a web developer is redesigning your nonprofit’s website for free, but a nearby organization recently paid for a website redesign, ask them what their developer’s hourly rate was and estimate the service’s FMV from there.

- The item’s provider. It can also be worthwhile to ask the donor for a value estimate on a hard-to-value gift. If an organization provides you with a free event venue, ask them about their going rate for renting out that space. For unique physical goods, take the provider’s estimate with a grain of salt—owners of signed celebrity memorabilia that is popular at auctions are prone to overestimating these items’ value.

- Supporter conversations. Especially when pricing auction items, contacting a few of the supporters who will likely bid on those prizes can help you get an idea of what they’d be willing to pay for them—or even what they’ve paid for similar items at other auctions.

Correctly valuing in-kind donations is not only important for auction item pricing but also for keeping accurate records of all contributions made to your organization. This practice helps promote transparency about your financial status, which can lead to increased confidence in your nonprofit and stronger donor relationships.

Are in-kind donations tax deductible for donors?

Yes. Both individuals and businesses can write off in-kind donations to nonprofits when filing their taxes. Like with tax-deductible monetary gifts, your organization just needs to issue the donor a written donation acknowledgment, which we’ll cover in the next section.

How should my nonprofit recognize in-kind donors?

At minimum, your nonprofit should issue an in-kind donation acknowledgment letter to each donor. This letter is important both for tax deduction purposes and for expressing gratitude. It should include:

- A personalized greeting. A donation acknowledgment needs to have the individual’s or business’s full name on it for the IRS to recognize it in tax filings. Additionally, beginning the letter with the recipient’s name shows that your organization values them as a partner in furthering your mission, not just a source of contributions.

- Basic information about the gift. This includes the type of goods or services that the donor contributed as well as the date the goods were received or the services were completed. However, your nonprofit isn’t legally allowed to list the monetary value of an in-kind donation in an acknowledgment letter. Instead, leave a space for the donor to fill in an estimated value themselves.

- Details about how the donation helped your nonprofit. This isn’t required for tax deductibility—it just helps donors see the impact of their donations. Including relevant pictures can emphasize the difference a gift makes. For instance, if a donor gave a gently used dog bed to an animal shelter, the shelter might send back a photo of a rescue dog sleeping on the bed so the donor knew their gift had been put to good use.

- A statement confirming that the donor wasn’t compensated for their gift. If you paid them in any way, the goods or services would no longer be considered a donation, and the payment would be taxable.

If someone gave a particularly valuable gift or you want your in-kind corporate sponsorship to be mutually beneficial, you should also consider recognizing the donor publicly. Posting shoutouts on your organization’s social media accounts, putting their name on a plaque at your facility, or including a blurb next to the prize they provided in your auction catalog are all great ways to steward in-kind donors.

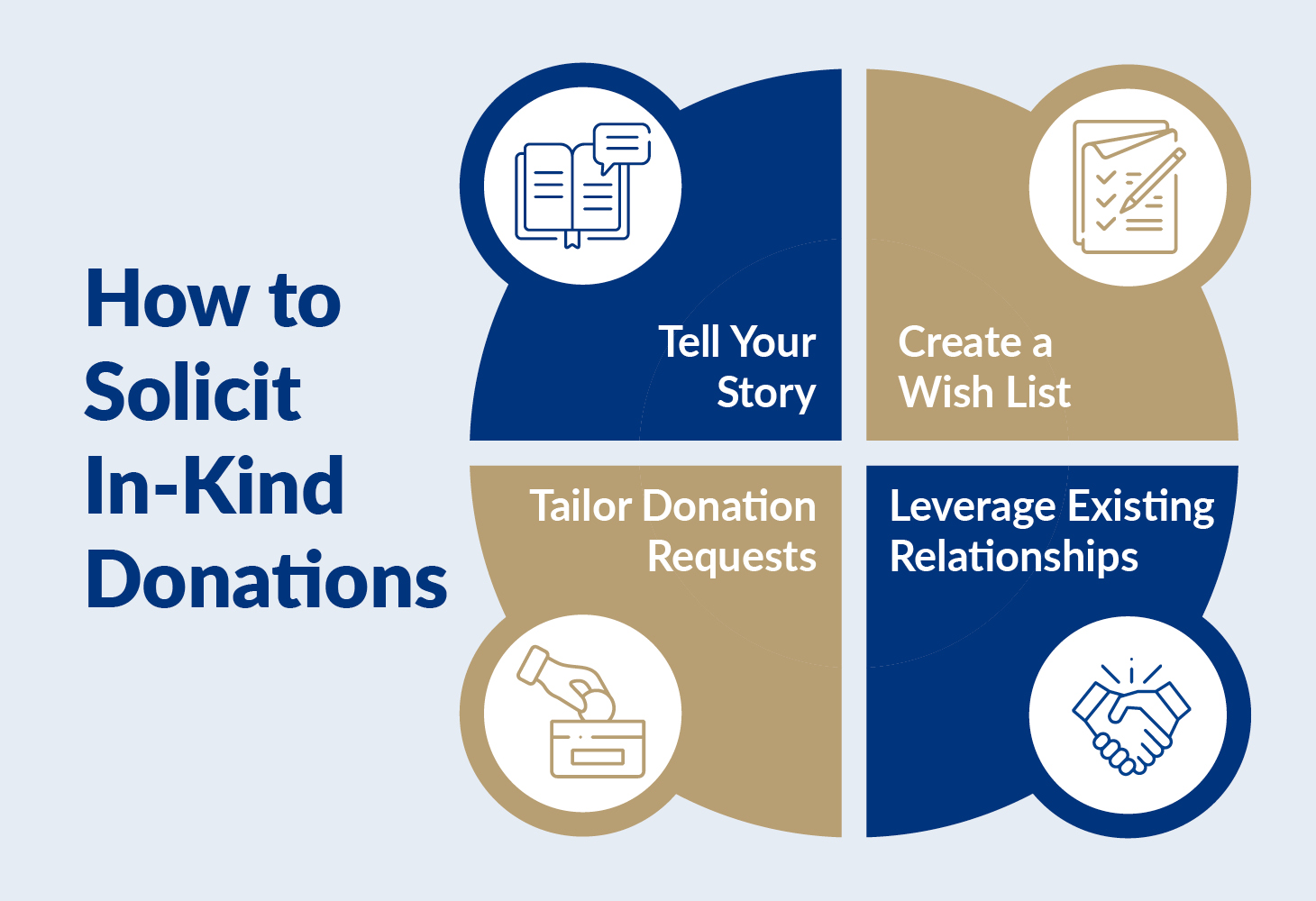

How to Solicit In-Kind Donations

Some nonprofits treat in-kind donations as a nice surprise or a donor free-for-all. However, you’re more likely to get what you actually need—while saving money and engaging your supporters—if you actively solicit gifts of goods and services.

Here are some strategies you can use to ask for in-kind donations more effectively:

- Create a donation wish list. We’ve talked about doing this for auction items, but it can also be helpful for supply drives. If you need general goods, such as canned food for a food pantry or used books for a library, make a flyer listing the items you need and the rules for donating to distribute in your community. If you’re looking for more specific supplies for a project, email an Amazon wish list to your supporters so they can each purchase an item for you that aligns with their budget.

- Leverage your nonprofit’s existing business relationships. Rather than approaching every potential corporate sponsor cold, see which local companies have supported your organization in the past and may be able to give you the goods or services you need. You can also ask your supporters to introduce you to their employers—if their employer has matched their donations or volunteer hours, you may already have a foot in the door for a sponsorship.

- Make tailored donation requests. When asking for in-kind donations from corporate sponsors or specific individuals, be specific about what you need from them and ensure they can help you. Rather than just writing, “We need auction items,” saying something like, “We would like your nail salon to donate a gift certificate for a mani-pedi as a silent auction prize,” shows that you’ve thought about how that business could best support you and helps them make an informed decision about whether to contribute.

- Tell a compelling story. Whether you’re making an individual request or sending out a mass call for in-kind donations, include details about your organization’s mission and what you hope to accomplish with your supporters’ gifts. With your beneficiaries’ or loyal supporters’ consent, incorporate their photos and stories of how they’ve seen past in-kind gifts to your nonprofit make a difference.

Keep in mind, however, that in-kind donations aren’t always the best way to meet your nonprofit’s needs. For example, donated services can be helpful for a project here and there, but it’s best to hire or contract a professional if you need more consistent expertise. Also, some types of auction items—especially vacations—are difficult to procure as in-kind donations, and you’d be better off buying them directly or going through a consignment provider like Winspire.

In-Kind Donations: The Bottom Line

In-kind donations can serve a variety of purposes at your nonprofit, as long as you procure them strategically. After every supply drive, fundraising event, or other collection of in-kind contributions, take note of what went well and where you can improve your strategy for soliciting and accepting these gifts.

For more information on in-kind donations and their nonprofit applications, check out these resources:

- Top 10 Types of Charity Auction Items + How to Procure Them. Discover our best ideas for nonprofit auction items, as well as whether you should solicit in-kind donations or use other methods to secure them.

- How to Organize a Fundraiser Auction in 10 Simple Steps. Item procurement is just one essential aspect of planning a charity auction—learn about the entire process in this guide.

- 20+ Exciting Raffle Basket Ideas for Nonprofit Fundraisers. Raffles are another fundraiser where in-kind donations can be used as prizes. Explore our ideas for creating attractive gift baskets with those contributions.